The Government holds the Biggest Shares in Vodafone Idea

The government is now the biggest shareholder in the (Vi) Vodafone Idea. Here are some facts that one should know regarding this change.

Vodafone, the third biggest telecom company, has converted the dues by giving a large stakeholding to the government. As a consequence of this decision, the promoter’s shareholding of Aditya Birla Group and Vodafone Plc. will now drop from 72% to 46%.

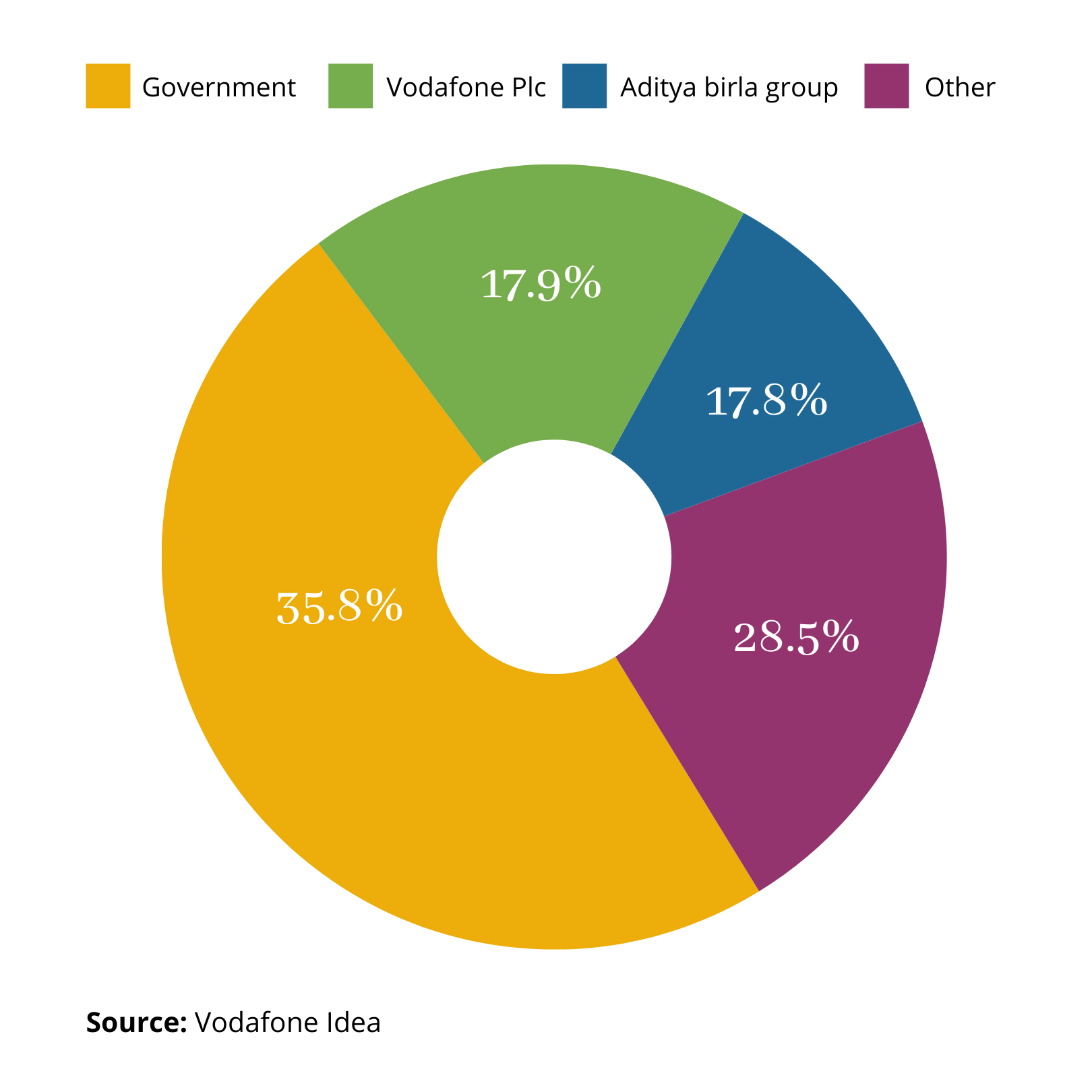

Now, the Government will hold 35.8% of the stakes in the company. This makes around ₹16,000 crores making the government the largest stakeholder in the company. Prior to this, Vodafone Idea (Vi) had gone with a four-year moratorium for AGR (adjusted gross revenue) dues and the spectrum.

1 What’s AGR?

AGR is:

‘A revenue-sharing model that was signed between telecom companies and the government back in 1999. According to that model, the telco requires to share the AGR they earn with the government. The government would collect it in the way of spectrum usage charges and annual license fees.’

The perfect definition of AGR is- it’s a license contract between the Telecom contractors and DoT (Department of Telecommunication). However, the DoT redefines the concept of AGR in the notification issued in October.

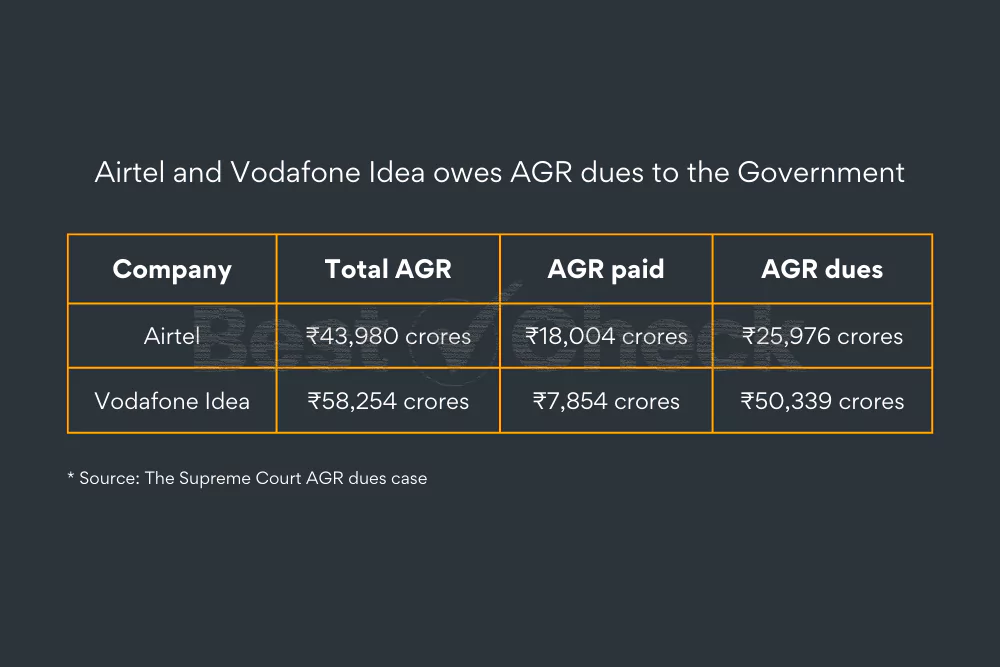

This revision removes almost all non-telecom income (revenue) from its content. Further, this might be utilized to calculate the Spectrum Usage Charges (SUC) and License charges that telecoms spend to pay to the government. The table in the above image shows how much Airtel and Vodafone Idea owes AGR dues to the government.

2 More from Vodafone Idea (Vi) regarding the Stockholdings

Back in the beginning months Vi decided to accept the government’s proposal to change the spectrum and AGR dues to equity, and make the government become the largest stakeholder.

After this conversion, the implied cost is ₹10 a share (32% discount) on the previous day’s closing price. With this conversion, our government now holds a 35.8% stake in the Vi company. The promoters– Aditya Birla Group and Vodafone Plc. will have 17.5% and 28.5%, respectively. These percentages are pretty less than initial shareholdings, 27.66% and 44.39%, respectively.

The reason behind the allotment of the shares to the government with ₹10 charges is that the average share price went below 10 INR in August 2021.

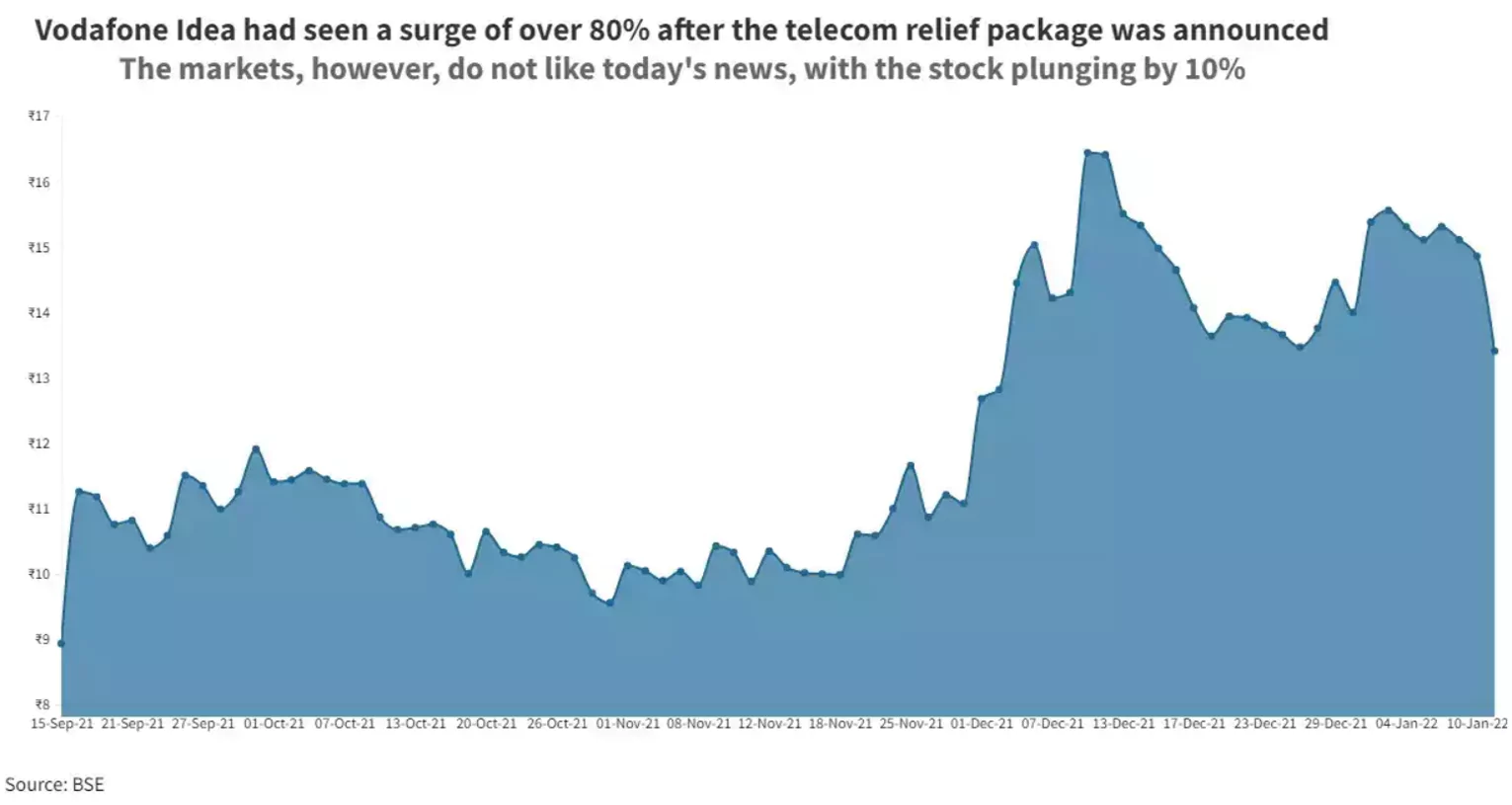

As the government holds the most significant part of the stake in Vodafone Idea, today’s Vi share prices have started to flourish a little more than before. Here’s what the official announcement that was made by the company looked like:

“The shares may be held through the statutory undertaking of the (SUUTI) Statutory Undertaking of the Unit Trust of India on behalf of the Government of India or by any trustee-type or other suitable arrangement.”

SUUTI is one government investment method that holds significant stocks of public companies like ICICI Bank, HDFS Bank, SBI, and others.

As per the company’s exchange filing, the present value of the interest that Vi owes to the government is around ₹16,000 crores. The DoT had presented various options to Vi and Airtel in October 2021 to get any telecom relief pack declared in September.

It included suspension of AGR dues and the Spectrum for 4 years and converting interest on the decided amount to shares. Vodafone Idea opted for a moratorium, while Airtel announced its success of raising $1 billion in funds from Google.

3 Final Words

Let’s hope that Vi would be able to raise funds and stabilize its position in the market until the next 5G spectrum appears in India. You can also check oneplus launch nord buds in india. For more latest updates, stay tuned with BestCheck.

Community Q&A

About This Article

Shreyal Shingala is a Content Writer and also a Product tester at BestCheck. Overseeing the content and products, she edits our preceding articles too. Along with that, she loves to spend time with her family when she got her leisure time. Previously, she worked as a content writer and researcher for a digital marketing agency and has written in different niches like blogs, comparison guides, entertainment, and many more.

This article has been viewed 1249 times.