The Ultimate Guide to Buying Government Bonds

If you’re looking to expand your investment portfolio or seeking a relatively secure way to grow your savings, buying government bonds can be a lucrative option. In the world of investing, government bonds, or ‘govies,’ are considered safe havens due to their low default risk. This blog will help you navigate the intricacies of government bonds, empowering you to make informed decisions when investing in this popular financial instrument.

1 Understanding Government Bonds

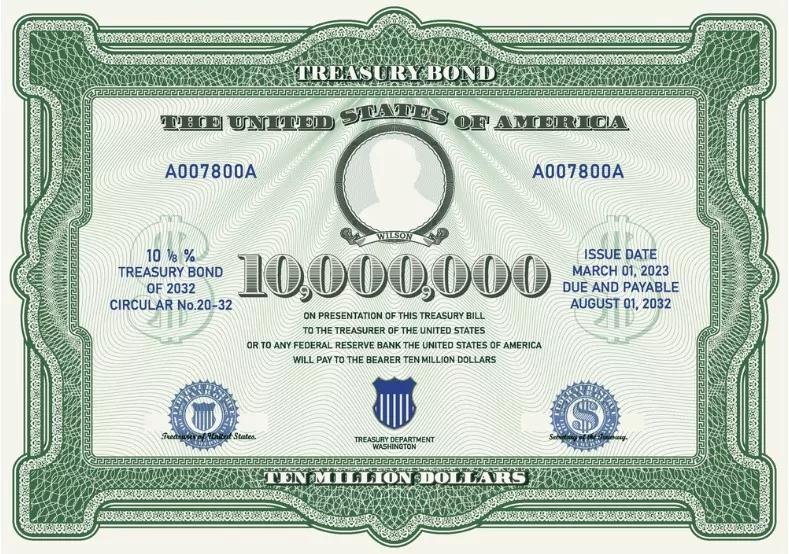

Before buying government bonds, it’s important to understand what they are. A government bond is a type of debt security that a government issues to support government spending and obligations. When you buy these bonds, you essentially lend money to the government, which promises to pay you back with interest at a later date, usually upon maturity.

Investors consider government bonds to be less risky than other types of investments because they are backed by the full faith and credit of a government. Countries like the United States, the United Kingdom, Germany, and Japan are famous for their highly rated and secure bonds.

2 Why Invest in Government Bonds?

The primary reason to invest in government bonds is security. These bonds are considered one of the safest investments because they are backed by the government, which can print money if necessary to pay back the bondholders. They provide a steady income stream and help diversify an investment portfolio, making them an excellent choice for conservative investors.

Despite offering lower yields compared to stocks or corporate bonds, the trade-off is a lower risk of losing your initial investment. As such, investors who are nearing retirement or seeking low-risk income often prefer government bonds.

3 How to Buy Government Bonds

Buying government bonds is a straightforward process and is accessible to all types of investors. Most government bonds can be purchased directly from the government through their respective treasury departments or through a broker or bank.

- Buying Directly from the Government: In the United States, for instance, you can buy bonds directly from the government through the Treasury Direct website. The UK offers a similar service through the Debt Management Office.

- Buying Through a Broker or Bank: If you’re interested in buying foreign government bonds or want assistance in buying domestic bonds, you can use a broker or bank. They can guide you through the process, advise you on the best options, and handle the transaction on your behalf.

4 Types of Government Bonds

When you decide to invest in government bonds, you’ll come across various types, each with different maturity dates, yields, and features.

- Treasury Bonds: These are long-term securities with a maturity period of more than ten years. They pay interest every six months until they mature when the face value is paid to the investor.

- Treasury Notes: These are medium-term securities with maturities ranging from 2 to 10 years. Like Treasury bonds, they also pay interest every six months.

- Treasury Bills: These are short-term securities that mature within a year. Unlike bonds and notes, they don’t pay regular interest. Instead, they are sold at a discount, and upon maturity, you receive the full face value.

- Savings Bonds: These are non-marketable securities, meaning you cannot trade them. They are ideal for small-scale investors and have a very low entry point.

- Inflation-Protected Securities (TIPS): The principal of these bonds is adjusted based on inflation. This ensures the value of your investment does not diminish over time due to inflation.

5 Pros and Cons of Buying Government Bonds

Pros:

Safety: Government bonds, especially those issued by stable governments like the U.S., are considered some of the safest investments around. They come with a low risk of default because they are backed by the full faith and credit of the government.

- Steady Income: They provide regular interest payments, typically semi-annually, creating a steady income stream for investors.

- Diversification: Government bonds can help diversify an investment portfolio. They often have a negative correlation with equities and can thus serve as a counterweight, helping to mitigate losses when stock markets are down.

- Liquidity: Government bonds are usually highly liquid investments, which means they can be easily bought or sold in the financial markets.

Cons:

Low Returns: In exchange for their safety and stability, government bonds typically offer lower returns than riskier assets such as stocks.

Inflation Risk: The fixed interest rates of bonds can be a disadvantage in times of high inflation. If inflation rises, the real value of the bond’s return could be diminished, or even become negative in real terms.

Interest Rate Risk: If interest rates rise, the price of existing bonds falls because newly issued bonds carry a higher yield, making the older bonds less attractive in comparison. This is a risk if you need to sell your bond before its maturity.

Opportunity Cost: Given their low risk, bonds typically offer lower potential returns than other investments. This means that investors could potentially miss out on higher returns from other assets if they choose to invest heavily in bonds.

Political and Economic Risk: In certain countries, political instability or economic mismanagement could increase the risk of default, making their government bonds risky investments.

6 Things to Keep in Mind When Buying Government Bonds

Before you invest in government bonds, consider these important factors:

- Interest Rate Risk: While government bonds are considered low-risk in terms of default, they do carry interest rate risk. If interest rates rise, the price of existing bonds falls. This isn’t a concern if you hold the bond to maturity, but if you need to sell before then, you may receive less than you initially paid.

- Inflation Risk: If the inflation rate surpasses the yield of the bond, it could erode your purchasing power over time. Inflation-protected securities can help mitigate this risk.

- Liquidity: Most government bonds are highly liquid, meaning they can be easily bought and sold. However, some, like savings bonds, cannot be sold and must be held until maturity.

7 Wrapping Up

Buying government bonds can be a wise investment decision, providing a relatively safe way to generate income and diversify your portfolio. It’s crucial to understand the different types of bonds, how they work, and the potential risks before investing. If in doubt, seek advice from a financial advisor to ensure you make the best decision for your financial future.

Remember, as with all investments, buying government bonds should align with your overall investment goals, risk tolerance, and time horizon. Happy investing!

Community Q&A

About This Article

This article has been viewed 405 times.