How to Activate Paytm Wallet: A Comprehensive Guide

In this age of digitalization, gone are the days when you needed to carry a hefty wallet packed with cash and cards. Today, digital wallets have transformed the way we transact. Among these, Paytm leads the pack in India. Launched in 2010, Paytm has rapidly become one of the most trusted digital payment platforms, boasting a user base of over 300 million. Paytm wallet, a critical aspect of the platform, enables users to store money virtually and use it for various transactions like mobile recharge, bill payments, shopping, and much more.

In this blog post, we will delve into the step-by-step process of how to activate Paytm Wallet, so you can join the digital revolution and make transactions with ease and security. So, let’s jump right into the process.

1 Setting Up a Paytm Account: A Step-by-Step Guide

Step 1: Download the App

Before activating your Paytm Wallet, you must have a Paytm account. To create one, start by downloading the Paytm app from the Google Play Store or Apple App Store. Once installed, open the app.

Step 2: Register

You will be prompted to register using your mobile number. Input your number, and you will receive an OTP (One Time Password). Enter the OTP to proceed.

Step 3: Set a Password

Create a secure password for your account. Ensure it’s a mix of letters, numbers, and special characters.

Step 4: Enter Personal Details

Provide your name, email address, and other necessary details. It’s recommended to link your email address, as it can be used for account recovery.

2 KYC Verification for Paytm Wallet

Step 1: Open Paytm App

Once you’ve created your account, open the Paytm app and log in using your credentials.

Step 2: Go to ‘KYC’

Select the ‘KYC’ option. You will be required to provide government-approved ID proof like Aadhaar, PAN, or Passport.

Step 3: Enter Details

Input the necessary details based on the ID proof you selected.

Step 4: Schedule an Appointment

In some cases, you might need to complete in-person verification. If required, schedule an appointment for a representative to come to your address for verification.

Step 5: Complete Verification

Once your KYC is verified, your Paytm Wallet will be activated.

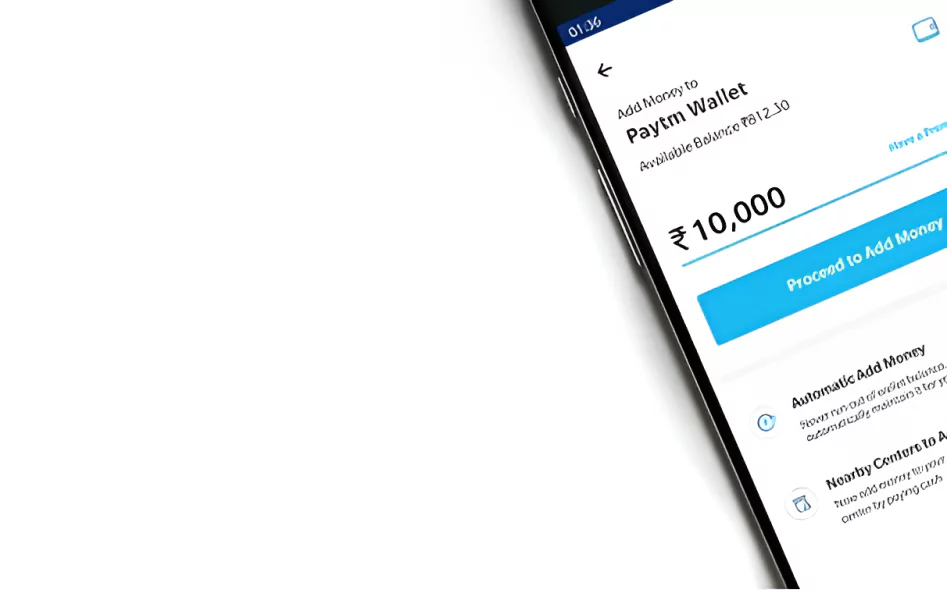

3 Adding Money to Paytm Wallet

Step 1: Select ‘Add Money’

Open the Paytm app, and select the ‘Add Money’ option.

Step 2: Enter Amount

Type in the amount you want to add to your wallet.

Step 3: Choose Payment Method

Select your preferred payment method – credit card, debit card, net banking, or UPI.

Step 4: Confirm the Transaction

Follow the prompts and confirm the transaction. The amount will be added to your Paytm Wallet.

4 Making Payments Through Paytm Wallet

Step 1: Choose the Payment Option

Open the Paytm app, select ‘Pay’ and choose between options like mobile recharge, bill payment, or sending money to someone.

Step 2: Enter Details

Enter the required details like the mobile number, account number, or scanning the QR code.

Step 3: Confirm the Transaction

Review the details and confirm the transaction. The amount will be deducted from your Paytm Wallet.

5 Tips for Secure Transactions

- Regularly change your password and choose a strong one.

- Avoid using public Wi-Fi for transactions.

- Verify the recipient’s details before confirming any transaction.

- Keep your app updated for the latest security features.

6 Troubleshooting and Customer Support

If you face any issue with your Paytm Wallet, you can reach out to the customer support through the app. Additionally, you can also visit the Paytm community forums to discuss any issues.

7 Conclusion

In conclusion, activating and using a Paytm Wallet is a simple and convenient process. It not only provides you with a cashless transaction experience but also ensures secure and rapid payments. So, shed the weight of your physical wallet, and embrace the ease and efficiency of Paytm Wallet today.

Also, to know more tips and tricks about Paytm, check out our blog on how to use Paytm cashback points.

FAQ's about How to Activate Paytm Wallet

What is the Paytm Wallet and why do I need it?

The Paytm Wallet is a digital payment instrument that allows you to make online transactions using your smartphone. It provides a quick, secure, and convenient way to pay for various services, shop online, and even transfer money.

Is there a minimum age requirement to activate a Paytm Wallet?

Yes, to activate and use a Paytm Wallet, you must be at least 18 years old, which is the legal age for entering into binding contracts in India.

I've set up a Paytm account, but how do I activate the wallet feature?

Once you’ve created a Paytm account, activating the wallet requires KYC verification. Post-verification, your wallet is automatically activated, and you can start adding money to it.

Can I use Paytm Wallet without completing KYC?

Limited features of the Paytm Wallet are available without KYC. However, to enjoy full benefits and higher transaction limits, KYC verification is mandatory.

How safe is it to link my bank account or card to the Paytm Wallet?

Paytm employs robust encryption technologies and follows strict security protocols, ensuring your linked bank or card details are safe. Additionally, always follow the provided tips for secure transactions to enhance safety.

Are there charges for transferring money from the Paytm Wallet to a bank account?

There may be nominal charges associated with transferring money from your Paytm Wallet to a bank account, especially if you’re a non-KYC user. It’s recommended to check Paytm’s official website or app for the latest fee structure.

How do I access customer support?

If you encounter any problems with your Paytm Wallet, you can navigate to the “Help & Support” or “24×7 Help” section in the Paytm app or website. Here, you’ll find solutions to common queries and the option to contact customer support directly.

Can I have more than one Paytm Wallet linked to different mobile numbers?

Yes, you can have separate Paytm Wallets for different mobile numbers. However, each number requires its own unique account and KYC verification.

Is there an expiry date for the balance in my Paytm Wallet?

No, the balance in your Paytm Wallet does not expire. You can use it for transactions as long as your wallet remains active.

What should I do if I lose my phone with the Paytm app installed?

If you lose your phone, immediately change your Paytm password using the website or another device. Also, notify Paytm customer support to take necessary precautions for safeguarding your wallet.

Community Q&A

About This Article

Hardik Jethva is an experienced author of the BestCheck family. Working from scratch, he has developed an amazing interest in testing and writing about different products in a transparent manner. His writing skills got more audience for BestCheck. Apart from his professional life, Hardik has his eyes on travelling, meditation, eating healthy food, socializing with people, and car rides.

This article has been viewed 450 times.