Learn How To Fill Cheque Correctly?

In today’s fast-paced digital world, knowing how to fill cheque might seem like an ancient art. However, cheques still hold an essential place in financial transactions. Understanding how to fill cheque properly is an indispensable skill that everyone should have. In this comprehensive guide, we will unlock the secret behind how to fill cheque effortlessly.

Cheques are paper instruments instructing a bank to pay a specific amount of money from a person’s account to another individual or organisation. Despite the rise of online banking, there is still a significant number of people who rely on cheques for various transactions. Thus, knowing how to fill cheque is vital.

1 Reasons for Using Cheques

Before diving into the details of how to fill cheque, let’s discuss why cheques are still popular:

- Record Keeping: Cheques provide a paper trail and are helpful in keeping financial records.

- Control: You get better control over your payments.

- Non-digital Transactions: For those who don’t have access to digital modes of payment, cheques become a necessity.

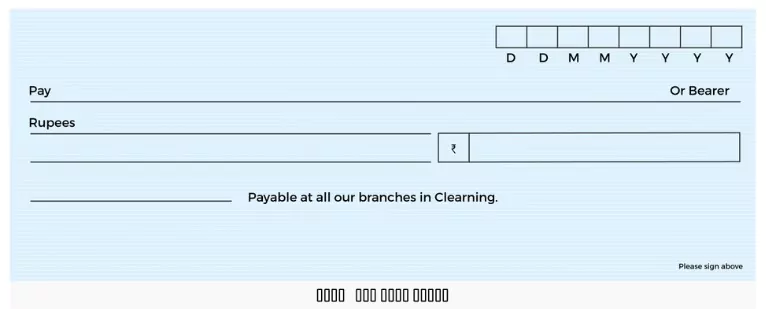

2 The Anatomy of a Cheque

To understand how to fill cheque efficiently, you need to be familiar with the components of a cheque.

- Drawer: The person who writes the cheque.

- Payee: The person to whom the cheque is payable.

- Drawee: The bank where the drawer has his account.

- Amount in Figures: The amount the drawer wants to pay, written in numbers.

- Amount in Words: The exact amount written in words.

- Date: The date when the cheque is written.

- Signature: The drawer’s signature.

- MICR Code: Magnetic Ink Character Recognition Code for security purposes.

- Cheque Number: A unique number identifying the cheque.

3 Step-by-Step Guide on How to Fill Cheque

Now that you know why cheques are still relevant and what makes a cheque, it’s time to learn how to fill cheque meticulously.

Step 1: Write the Date

This is where your journey of how to fill cheque begins. Write the current date. Make sure you use the correct format, which usually is Month-Day-Year or Day-Month-Year.

Step 2: Write the Name of the Payee

For whom is the cheque? Write the name of the person or organisation. Ensure that the spelling is correct; otherwise, it might cause problems during encashment.

Step 3: Write the Amount in Figures

This is a critical part of learning how to fill cheque. Write the amount you want to pay in numbers inside the box. Start as close to the “₹” sign as possible to prevent anyone from adding numbers.

Step 4: Write the Amount in Words

Another crucial step in how to fill cheque is writing the amount in words. This must match the figure you have written. Don’t forget to mention the cents as well.

Step 5: Sign the Cheque

The most crucial step in how to fill cheque is signing it. Sign the cheque in the lower right-hand corner. Use the same signature that you provided to the bank when you opened your account.

Step 6: Add a Memo (Optional)

This is an optional step but is beneficial in keeping records. You can write a note to remind yourself why you issued the cheque or for the recipient to know the purpose.

4 Additional Tips on How to Fill Cheque Securely

Learning how to fill cheque is not just about writing the cheque but ensuring that it’s done securely.

Use a Pen: Always use a pen – preferably one with black ink.

Never Overwrite: If you make a mistake, it’s better to start over with a new cheque than make alterations.

Cross the Cheque: To enhance security when you’re learning how to fill cheque, add two parallel lines on the top left corner of the cheque. This means the cheque can only be deposited into a bank account and not encashed at a bank counter.

Write ‘A/C Payee’: When crossing the cheque, write “A/C Payee” between the two parallel lines. This ensures that the cheque can only be deposited into the account of the person whose name is mentioned as the payee.

Leave No Spaces: When you write the amount in words and figures, ensure that there are no gaps anyone can use to alter the figures.

5 The Relevance of Cheque in the Modern World

Now that you know how to fill cheque securely, let’s delve into their relevance in today’s world. Cheques act as an alternative to cash that is more secure and sometimes more convenient, especially for large amounts.

- Business Transactions: Many businesses prefer using cheques for their transactions as they are easier for accounting purposes.

- Trust Building: Issuing a cheque can sometimes be seen as a sign of trust, as it requires the payer to have the necessary funds for the cheque to clear.

6 Common Mistakes to Avoid

When it comes to how to fill cheque, here are some common mistakes that you should avoid:

- Incorrect Date: This is one of the most common mistakes. Always double-check the date.

- Mismatch Between Amount in Figures and Words: This can cause a cheque to bounce, so make sure they match.

- Unsigned Cheque: An unsigned cheque is like an unsigned contract – invalid.

7 Wrapping Up

Mastering how to fill cheque is an essential life skill that can be useful in numerous situations. Cheques offer a reliable and often necessary alternative to cash and digital transactions. When writing a cheque, it’s crucial to pay attention to detail to ensure that your cheque is filled out correctly and securely. Make sure to follow the steps outlined in this guide on how to fill cheque to become proficient in this vital skill. By knowing how to fill cheque correctly, you not only ensure the safety and validity of your transactions but also exude professionalism and reliability in your financial dealings.

FAQ's about How to fill Cheque

What happens if a cheque is not crossed?

If a cheque is not crossed, it is an open cheque and can be encashed at the bank counter.

What if my cheque is dishonoured?

If your cheque is dishonoured, it means that the cheque cannot be processed due to either insufficient funds or incorrect details. This can sometimes result in a penalty.

Can I post-date a cheque?

Yes, you can write a future date on a cheque, it’s called a post-dated cheque. However, it cannot be cashed until the date written on the cheque.

Community Q&A

About This Article

This article has been viewed 464 times.