From Earnings to Empowerment: How to Manage Salary?

Financial stability is a goal for many of us. Yet, even with a regular paycheck, we sometimes struggle with making ends meet. Ever wondered how to manage salary effectively? or how to spend salary wisely? If these questions resonate with you, you’re in the right place.

Managing one’s salary is a skill we should all possess, yet not many are taught. With rising costs of living, it becomes increasingly crucial to understand how to manage your salary every month. In this guide, we’ll discuss tips and strategies to ensure you make the most of every paycheck.

1 Why is Managing Salary Essential?

Before diving into the methods, let’s establish why managing salary is vital. With inflation, fluctuating economies, and unexpected expenses, a well-planned budget can be your financial safety net. It can help you meet your current needs, save for future aspirations, and prepare for unforeseen circumstances.

2 Steps to Manage Salary Effectively

Understanding Your Income and Expenses

- Track Every Penny: The first step is to understand where your money comes from and where it goes. Maintain a log of all your income and expenses.

- Distinguish Between Fixed and Variable Expenses: While fixed expenses like rent or mortgage remain constant, variable expenses like entertainment or dining out can change. Recognizing these can help in the better allocation of funds.

Set Clear Financial Goals

- Whether you aim for a new car, a house, or just a rainy-day fund, having clear goals can guide your spending and saving habits.

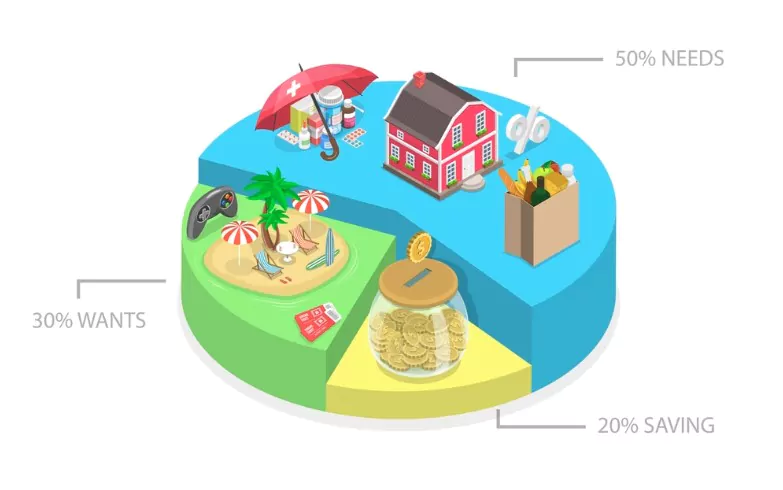

3 The 50/30/20 Rule - A Golden Ratio

One of the most recommended frameworks when deciphering how to spend salary wisely is the 50/30/20 rule. It is a simple yet effective method:

- 50% Needs: Half of your income should cover essentials like rent, groceries, and utilities.

- 30% Wants: This includes non-essentials, perhaps a fancy dinner or that pair of shoes you’ve been eyeing.

- 20% Savings & Debt Repayment: Whether it’s saving for the future or paying down debt, this part of your salary should be non-negotiable.

The beauty of the 50/30/20 rule is its simplicity and adaptability. It offers a structured way of dividing your income while allowing flexibility based on individual needs and goals.

4 Create A Budget

Using the 50/30/20 rule, create a budget that breaks down your income. It will not only offer clarity but will also empower you with control over your finances. Remember to review and adjust this budget periodically.

5 Control Impulse Spending

To master how to manage your salary every month, control over impulse purchases is crucial. These can quickly drain your finances. A helpful strategy can be the 24-hour rule: wait for a day before making a significant purchase to determine if it’s genuinely necessary.

6 Build An Emergency Fund

Emergencies are unpredictable. An essential aspect of managing salary is ensuring that you have an emergency fund for unforeseen circumstances. This fund should ideally cover three to six months’ worth of living expenses.

7 Save Before You Spend

This might sound like a cliché, but it’s a golden rule. Once you receive your salary, allocate funds to savings before you start spending. This disciplined approach ensures you don’t overlook your savings goals.

8 Invest Wisely

While saving is essential, investing is what will make your money work for you. Understand the basics of investment and make informed decisions. Whether it’s stocks, mutual funds, or real estate, choose avenues that align with your financial goals and risk tolerance.

9 Seek Professional Advice

If you’re unsure about managing salary or investments, don’t hesitate to seek advice from financial experts. They can provide tailored guidance based on your financial situation.

How to Spend Salary Wisely?

Now that we’ve covered how to manage your salary every month, let’s focus on spending wisely.

- Prioritise Needs Over Wants: As simple as it sounds, it’s often the hardest to implement. Always prioritise necessities and delay or reconsider non-essential purchases.

- Research Before Buying: Whether it’s a new gadget or service, do thorough research. Look for deals, discounts, or alternatives that offer better value.

- Limit Use of Credit: Using credit cards can be tempting. However, it’s essential to understand they’re not ‘extra money.’ Only spend what you can repay in full to avoid debt traps.

10 Tools and Resources for Managing Salary

There are numerous digital tools available that can assist you in managing your finances:

- Budgeting Apps: Apps like Mint or YNAB can help you keep track of your income, and expenses, and offer insights into your spending habits.

- Online Calculators: Use online tools to calculate potential savings, investment returns, or debt repayment timelines.

- Financial Advisors: For those unsure about financial decisions, consider seeking guidance from professionals. They can provide tailored advice based on your financial situation.

11 Wrapping Up

How to manage salary is not just about restricting expenses; it’s about making informed decisions. With the right tools, mindset, and strategies, you can make your money work for you. By adopting the 50/30/20 rule, setting clear goals, and continuously educating oneself, one can achieve a balance between enjoying the present and preparing for the future.

Remember, managing salary isn’t a one-time task. It’s an ongoing process that adapts to time and changing circumstances. So, stay proactive, stay informed, and make the most of every paycheck.

Community Q&A

About This Article

This article has been viewed 373 times.