A Guide on How to Save Tax on Salary?

When it comes to personal finance, one query that’s always on the minds of salaried individuals is “How to save tax on salary?”. It’s no secret that taxes can take away a sizable chunk of your hard-earned money. However, with astute planning and strategic investments, you can significantly reduce your tax liability. In this detailed and informative guide, let’s dissect the various avenues that can help you in achieving this goal.

1 Understanding the Basics

Before diving into the intricacies of how to save tax on salary, it is crucial to understand the basics of income tax. In most countries, including the United States and India, the income tax structure is progressive. This means that as your income increases, you’re subjected to higher tax rates. For salaried individuals, it’s essential to know the tax slabs and how they are applicable to your income.

2 Utilising Deductions and Allowances

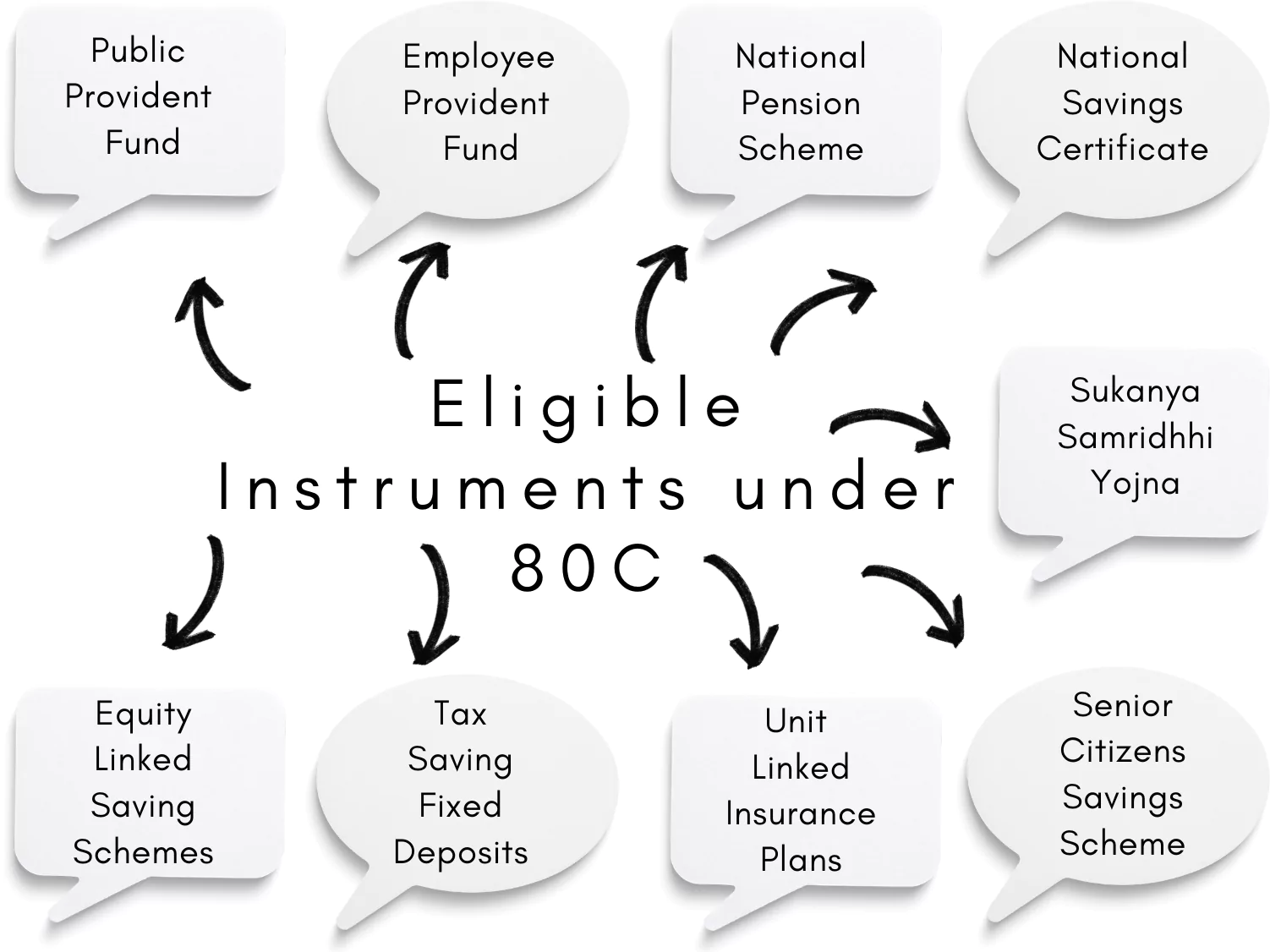

1. The Power of Section 80C (India)

For individuals in India wondering how to save tax on salary, Section 80C of the Income Tax Act is a golden provision. It allows deductions up to INR 1.5 lakh on certain investments and expenses, such as Employee Provident Fund (EPF), Public Provident Fund (PPF), National Savings Certificate (NSC), and payment towards the principal amount of home loans.

2. HRA and Standard Deduction

Housing Rent Allowance (HRA) is another excellent avenue to save tax for salaried individuals. You can claim a deduction for the rent you pay if you live in a rented house. Similarly, a standard deduction is available for salaried employees, which automatically reduces the taxable income.

3. Health Insurance Premiums

When contemplating how to save tax on salary, don’t overlook health insurance premiums. In India, under Section 80D, premiums paid for health insurance for yourself, spouse, children, and parents qualify for a deduction.

For US taxpayers, the premiums paid for health insurance can be deductible if you itemise deductions and if they, along with other medical expenses, exceed a certain percentage of your adjusted gross income.

4. Educational Loan Interest

If you’re repaying an educational loan, the interest paid on the loan is deductible under Section 80E in India. In the US, you can also deduct interest paid on student loans under certain conditions.

3 Plan Your Investments Wisely

5. Retirement Savings Plans

In the United States, 401(k) and Individual Retirement Accounts (IRAs) are excellent tools for those figuring out how to save tax on salary. Contributions to these accounts are tax-deductible up to a limit.

For Indian residents, investing in the National Pension System (NPS) is a smart move. Not only does it help in building a retirement corpus, but it also offers additional deductions over and above the limit provided under Section 80C.

6. Equity-Linked Savings Scheme (ELSS)

For those in India, ELSS mutual funds not only provide you with the opportunity to earn market-linked returns but also save taxes under Section 80C.

4 Avail Tax Benefits on Home Loans

7. Home Loan Principal and Interest

In India, the principal repayment of a home loan is eligible for a deduction under Section 80C. Additionally, the interest paid on a home loan is deductible under Section 24(b).

In the US, mortgage interest on the first and second home can be deducted if you itemise deductions.

5 Make Use of Tax-Advantaged Accounts

8. Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) (US)

For US residents, Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) are crucial tools when figuring out how to save tax on salary. FSAs allow you to use pre-tax dollars for qualified medical expenses, while HSAs, paired with high-deductible health plans, allow you to set aside pre-tax income for future medical expenses. The money in an HSA can also be invested, and withdrawals for qualified medical expenses are tax-free.

9. Dependent Care FSA (US)

Another option for US taxpayers is the Dependent Care FSA, which allows you to use pre-tax dollars to pay for qualified expenses related to the care of a child or dependent adult.

6 Optimise Your Tax Filings

10. Itemise or Standard Deduction (US)

In the US, taxpayers have the option to take a standard deduction or itemised deductions. By itemising, you may be able to reduce your taxable income even further. It’s important to analyse your expenses and see if itemised deductions are more beneficial.

11. Choose the Right Tax Regime (India)

In India, taxpayers have the option to choose between the old tax regime and the new simplified tax regime. The old regime allows for various deductions and exemptions, whereas the new regime offers lower tax rates but with minimal deductions. Analyse which regime is more beneficial for you.

7 Education and Tuition Fees Deduction

12. Save Tax on Children’s Education (India)

For those who are still pondering how to save tax on salary, in India, tuition fees paid for children’s education can also be claimed under Section 80C.

13. American Opportunity Tax Credit (US)

In the US, the American Opportunity Tax Credit allows taxpayers to claim a credit for qualified education expenses for the first four years of higher education.

8 Additional Tips on How to Save Tax on Salary

14. Professional Development and Tools

Sometimes, expenses incurred on professional development and tools required for your job can be tax deductible. This is especially true if you are self-employed or a freelancer.

15. Tax-loss Harvesting (US)

For individuals who invest in stocks or mutual funds, tax-loss harvesting can be a strategy to lower your tax liability. This involves selling securities at a loss to offset a capital gains tax liability.

16. Charitable Donations

Making donations to charitable organisations can also help in reducing your tax liability. In both India and the US, you can claim a deduction for donations made to eligible charities.

9 Wrapping Up

With so many avenues available, saving tax on salary requires careful planning and an understanding of the various deductions and exemptions available. The keyword in this journey is being proactive. Understanding how to save tax on salary and implementing strategies can lead to significant savings, which can be further invested for wealth creation.

So, if you’re a salaried individual looking for ways to keep more of your hard-earned money in your pocket, it’s essential to stay informed and make smart financial decisions. Whether it’s maximising your contributions to retirement accounts, making intelligent investments, or claiming deductions for expenses like health insurance and educational fees, there’s a multitude of strategies available to reduce your tax liability.

In your quest how to save tax on salary, it’s also prudent to consult a tax advisor who can provide tailored advice based on your specific financial situation. Remember, every penny saved is a penny earned, especially when it comes to taxes.

Community Q&A

About This Article

This article has been viewed 438 times.