How To Use Flipkart Pay Later? A Complete Guide

In the digital era, shopping has turned into a simple click-and-cart experience, and it’s all about convenience and flexibility. A stellar example of this is Flipkart, one of India’s leading e-commerce platforms, with its forward-thinking option, “Flipkart Pay Later”. This ingenious feature has been designed with the customer’s shopping ease in mind, allowing them to make multiple purchases throughout the month without immediate payment. This blog will give a comprehensive guide on “how to use Flipkart Pay Later” for a simplified and streamlined online shopping experience.

1 The Magic of Flipkart Pay Later

Before we delve into the nitty-gritty of how to use Flipkart Pay Later, it’s crucial to understand the concept itself. Flipkart Pay Later is a form of digital credit that allows customers to buy products from the Flipkart platform and make the payment at a later date. The key benefit is the opportunity to consolidate all your purchases within a month into a single bill that can be paid off in one go.

2 Eligibility for Flipkart Pay Later

If you are excited about this feature and wondering how to use Flipkart Pay Later, it is essential to know if you are eligible. Currently, this feature is available for select customers based on their shopping patterns, frequency, and customer loyalty. Flipkart uses an internal algorithm to determine which customers qualify for this feature. You can check your eligibility by logging into your Flipkart account and visiting the ‘My Account’ section.

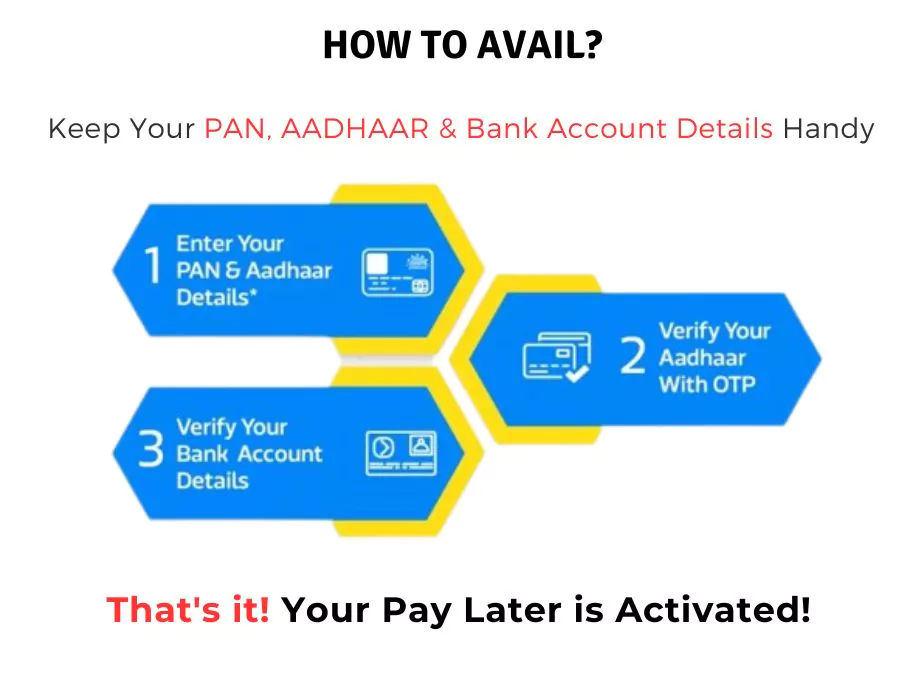

3 How to Use Flipkart Pay Later: Step-by-Step Guide

Now, let’s delve into the step-by-step process of how to use Flipkart Pay Later.

- Login to Flipkart: The first step on how to use Flipkart Pay Later begins by logging into your Flipkart account. You need to have an existing account with Flipkart to avail this feature.

- Check Eligibility: Navigate to the ‘My Account’ section and click on the ‘Flipkart Pay Later option. If you are eligible, the option will be activated.

Choose Products: Proceed to browse and select the products you wish to buy. Add them to your cart as you usually would. - Select Flipkart Pay Later: On the payment page, select the ‘Flipkart Pay Later’ option as your payment method. It will automatically deduct the amount from your available credit.

- Confirm Purchase: Confirm your purchase and enjoy the convenience of shopping now and paying later.

- Make Payment: At the beginning of the following month, you will receive a consolidated bill for all your purchases. The payment for this can be made through the ‘Pay Now’ button in the ‘Flipkart Pay Later’ section of your account.

This method highlights how to use Flipkart Pay Later for a flexible, budget-friendly shopping experience.

4 Advantages of Using Flipkart Pay Later

Understanding how to use Flipkart Pay Later is not just about knowing the process; it’s also about realising the benefits it offers. Here are some advantages of using this feature:

- Convenience: You can make multiple purchases throughout the month without having to pay instantly for each transaction.

- One Bill: At the end of the month, you receive a single bill consolidating all your purchases, simplifying tracking and payment.

- No Extra Charge: If the bill is paid in full by the due date, there are no extra charges or interest applied.

- Budget Management: It aids in better financial planning and budget management, as you know exactly when and how much to pay.

- Credit Availability: If you’re running short of funds at the moment, Flipkart Pay Later can come in handy, ensuring a seamless shopping experience without any interruptions.

5 Things to Consider When Using Flipkart Pay Later

While there are plenty of advantages to knowing how to use Flipkart Pay Later, there are also some points to be mindful of:

Pay On Time: Ensure that you pay the monthly bill on time to avoid any extra charges. Delayed payments can result in penalties and may also affect your eligibility for the service in the future.

Spending Wisely: It’s essential to use this feature wisely and not see it as an opportunity for unchecked spending. Be mindful of your purchases and remember, you will have to pay for them at the start of the next month.

Tracking Purchases: Regularly check your Flipkart Pay Later account to keep track of your purchases. This can help in better budget management.

6 Wrapping Up: The Future of E-Commerce

The convenience that Flipkart Pay Later brings to the table is a testament to the innovative advancements e-commerce platforms are making to enrich customer experiences. Knowing how to use Flipkart Pay Later enables a more flexible, convenient, and financially smart way of shopping online. As we move further into the digital age, it is these features that will shape the future of e-commerce.

To sum up, the “How to use Flipkart Pay Later” journey is about more than just a payment feature. It is about empowering customers, fostering better financial planning, and making online shopping a smooth and streamlined experience. If you are eligible for this service, we encourage you to embrace this new-age shopping revolution. Happy shopping!

FAQ's about Flipkart Pay Later

How much credit can I get with Flipkart Pay Later?

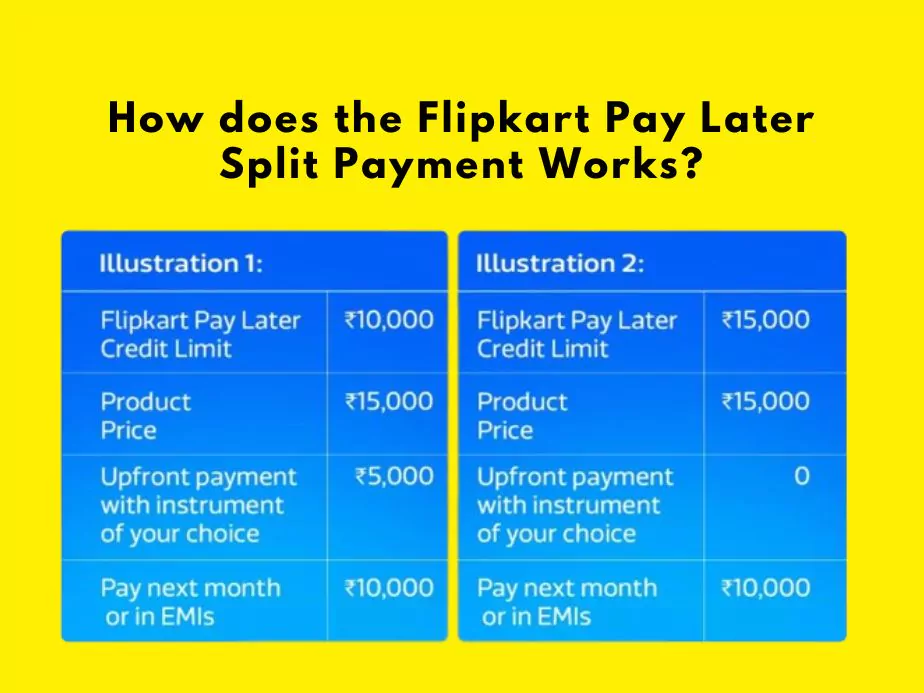

The credit limit for Flipkart Pay Later is decided based on your shopping patterns and frequency. It can range from Rs. 5,000 to Rs. 10,000.

Can I use Flipkart Pay Later for all products?

The Flipkart Pay Later option is available for most products on the platform. However, some items or sellers might not offer this payment method.

What happens if I miss my Flipkart Pay Later payment?

If you miss the payment deadline, you will be charged a late fee, and your credit score may be impacted.

Can I pay my Flipkart Pay Later bill in parts?

No, the bill has to be paid in full by the due date to avoid any additional charges.

Can I return a product bought using Flipkart Pay Later?

Yes, the return process remains the same regardless of the payment method. The amount for returned products will be adjusted in your next bill.

Community Q&A

About This Article

This article has been viewed 533 times.